72 Microfinance institutions join inaugural Financial Inclusion Index

Nordic Microfinance (NMI) is one of 19 founding partners of a groundbreaking Financial Inclusion Index launching in Q2 2022

Nordic Microfinance (NMI) is one of 19 founding partners of a groundbreaking Financial Inclusion Index of 72 microfinance institutions.

60 Decibels will release the first Financial Inclusion Index driven entirely by end customer voices in Q2 2022, in a global effort to promote standard, comparable impact outcomes data for the financial inclusion sector. NMI has supported 4 of our portfolio companies in participating in the index.

Collected through phone surveys, the data and resulting insights will be shared in a public report and dashboard to establish performance benchmarks for ongoing impact measurement and management by MFIs and their funders.

“Having access to such a large volume of comparable customer feedback is a crucial step for our participating portfolio companies, NMI, and the financial inclusion sector to better understand the effect of inclusive finance on people’s lives,” said Lone Søndergaard, Senior Investment and Impact Manager, NMI.

For each participating microfinance institution (MFI), 60 Decibels researchers have surveyed a representative sample (200 – 250 respondents) of customers and conducted a standardized phone survey to gather quantitative and qualitative data along five key dimensions of impact. The survey, developed by 60 Decibels and based on experience working with hundreds of companies in the financial inclusion space, utilizes questions proven to assess and compare social outcomes across five impact themes:

- Access

- Business Impact

- Household Impact

- Financial Management

- Resilience

The aggregated data from all participating MFIs will establish benchmarks to be shared in the public report, providing essential insight into the range of performance on these key outcomes to be utilized across the MFI industry.

“We started listening to end customers eight years ago because the standard of practice—things like counting the number of customers reached—wasn’t telling us if people’s lives were improving,” said Sasha Dichter, CEO and co-founder of 60 Decibels. “We’re thrilled at the response to this initiative and the collaboration of so many industry leaders to listen better and set a new standard in understanding social outcomes. This Index brings the value of our impact benchmarks to a new level and helps MFIs and investors understand customer outcomes with 100% comparability for each and every metric.”

In addition to providing insights that will be directly applicable for impact management in the financial inclusion sector, the index signals and demonstrates the value of rigorous outcomes data from end stakeholders for understanding impact performance. In the coming year, 60 Decibels will produce sector-level benchmarks through similar index efforts in other sectors to elevate the importance of listening to end stakeholders to drive greater impact.

The index is designed to complement and integrate with existing frameworks and standards in microfinance, impact investing, and international development. Participation in the Financial Inclusion Index to conduct surveys with clients provides MFIs and investors with feedback on the practices recommended by SPTF and CERISE in the Universal Standards and the Client Protection Principles, as well as the SDG Impact Standards, and provides data aligned to IRIS+ metrics and the five dimensions of impact guidance established by the Impact Management Project.

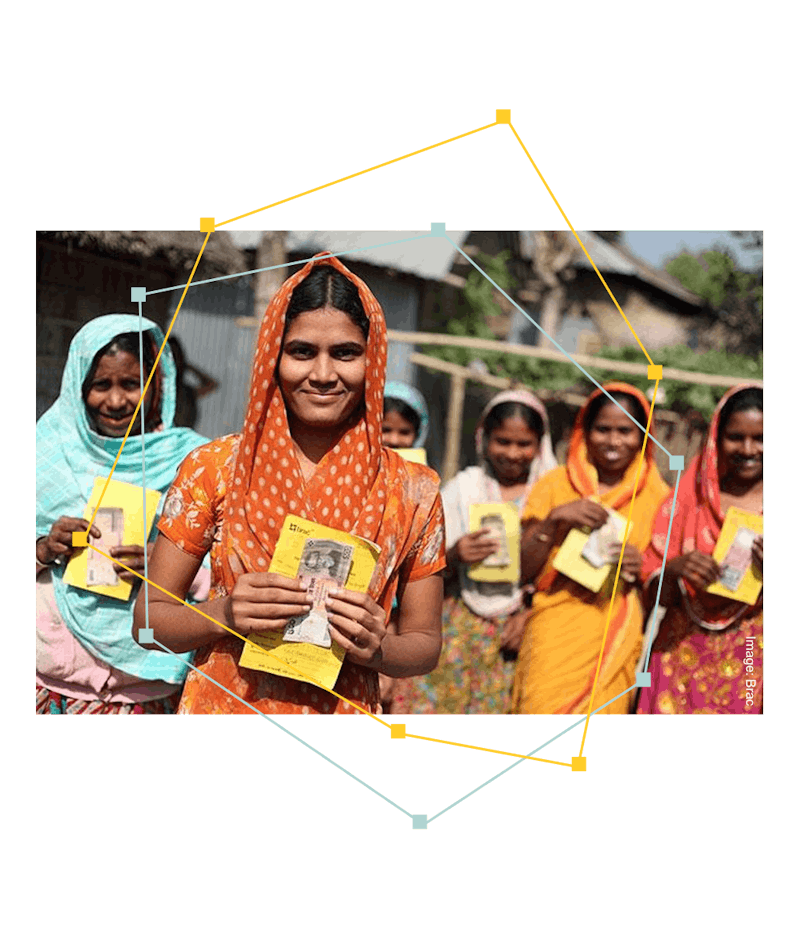

Global MFI participation has been made possible by 18 Founding Partners supporting and collaborating on this initiative, in addition to Nordic Microfinance Initiative: Accion, Advans, BRAC, ECLOF, FMO, Fundación Netri, Global Partnerships, Grameen Foundation, Kiva, LeapFrog Investments, MCE Social Capital, Opportunity International, Pro Mujer, ResponsAbility, SPTF, Symbiotics, WaterEquity, and Women's World Banking.

Sponsorship for this inaugural effort came from the Tipping Point Foundation on Impact Investing and Ceniarth. Together, these sponsors and founding partners have provided project funding and engaged their portfolios to include MFIs from 41 countries in this research.

Learn more and sign up to receive the 60 Decibels Financial Inclusion Index here.

About 60 Decibels

60 Decibels is a global, tech-enabled impact measurement company that brings speed and repeatability to social impact measurement and customer insights. We provide genuine benchmarks of impact performance, enabling organizations to understand impact relative to peers and set performance targets. We have a network of 850+ researchers in 70+ countries, and have worked with more than 800 of the world’s leading impact investors, companies, foundations, corporations, NGOs, and public sector organizations. 60 Decibels makes it easy to listen to the people who matter most.

About Nordic Microfinance Initiative (NMI)

Established in 2008 in Oslo, Norway, as a public-private partnership, NMI invests in and supports institutions providing financial inclusion to poor people in developing countries. Both positive social impact and sustainable financial returns are targeted, and our investors include the Norwegian and Danish governmental funds for developing countries (Norfund and IFU) and private financial institutions including DNB, Ferd, KLP, Lauritzen Fonden, PBU, TD Veen and Koldingvej 2, Billund A/S

Want to learn more about NMI? Check out our 2-minute Fact Sheet