Impact Report Q1 2023

How does access to responsible financial services play a meaningful role in enabling low-income households in developing countries to build better lives?

This quarter we examine how improved financial management impacts outcomes for our end customers, as well as a product snapshot on Svasti Microfinance's medical insurance and our contribution to the Sustainable Development Goals.

Check out our latest Impact Report for Q1 2023!

borrowers in Sub-Saharan Africa and Asia supported since 2008

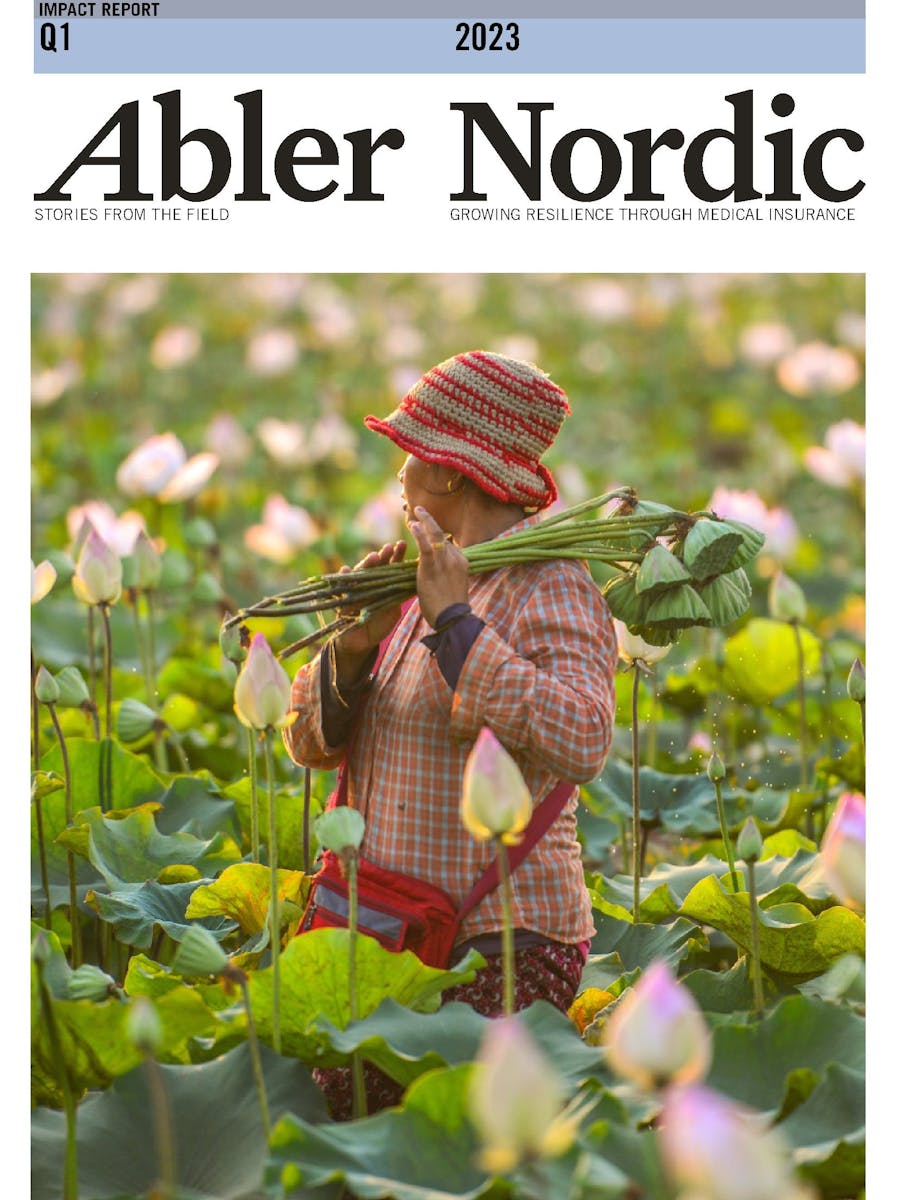

Growing resilience for slum communities with medical insurance

In the report we take a look at the positive impact our portfolio company Svasti Microfinance is generating with the introduction of medical insurance for their customers. Svasti provide financial services to women living in slum communities in urban and semi-urban areas in India. Healthcare in these communities is extremely complex, driven by poverty, environmental challenges and poor access to formal health infrastructure. Many Indians working in the informal sector who are particularly vulnerable to the financial burden of health shocks, as historically the cost of medical insurance has been high—and the benefits limited.

Spotlight on Financial Management - 60 Decibels Microfinance Index

As part of our series on insights from the 2022 60 Decibels Microfinance Index, we take a look at the impact loans have on customers' ability to manage their finances, whether their financial stress levels have decreased, the degree to which they understand loan conditions, and whether they find repayments a burden. While microfinance has proven highly beneficial to clients and households, access to finance, especially to loans, comes with risk: overindebtedness—something which Abler Nordic carefully monitors.

Read our Impact Report Q1 2023