Cashless is king: NMI invests in Musoni Microfinance

NMI and Musoni Microfinance have signed a 3 million USD loan agreement. The funds will enable the innovative Kenyan microfinance institution to take further steps...

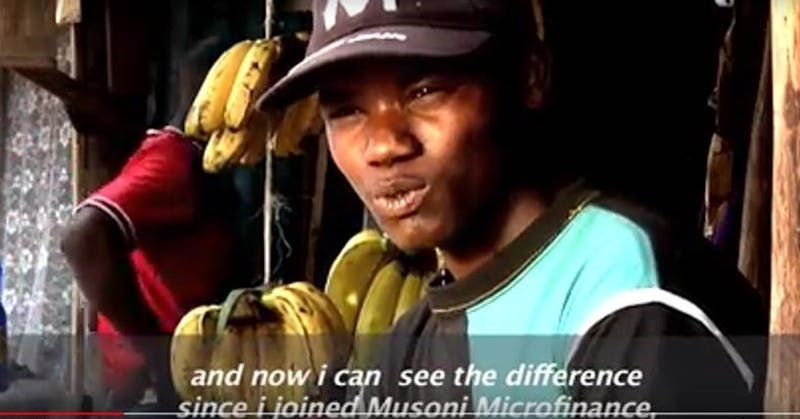

Watch a short video about Musoni Microfinance here!

NMI and Musoni Microfinance have signed a 3 million USD loan agreement. The funds will enable the innovative Kenyan microfinance institution to take further steps in their pursue to grow, build and maximize the potential of the businesses of the low income and unbanked of Kenya. By offering cashless loans, Musoni Microfinance is able to provide quick and efficient credit services to its 30,000 and growing clients.

“Musoni’s cashless and tech driven approach shows how first movers increase outreach - and benefit clients - in an efficient way. We are very pleased to invest in Musoni’s growth” says Arthur Sletteberg, NMI’s Managing Director.

"This facility is another solid step in Musoni’s journey towards deepening financial inclusion in rural areas, and in particular promote economic empowerment of the local societies by lending to small holder farmers under its flagship and flexible Kilimo Booster Loan product." says Stanley Munyao, CEO, Musoni Microfinance. "The partnership with NMI will help us deliver on our mission to provide technology-driven financial solutions that deliver social impact to our target clients in a financially responsible manner."

Visit Musoni Microfinance here.