Abler Nordic Impact Report | Q4 2023

How are digital solutions boosting rural financial inclusion?

Take a look at our Q4 2023 Impact Report!

Technology is front and centre in this issue— we examine three cases from our portfolio companies in India and Sub-Saharan Africa that show different ways digital services can be applied to broaden access to financial services for low-income households in remote areas.

Abler Nordic's Digital Transformation Officer Steinar Sæther shares perspectives on investing with a digital mindset and the importance of balancing digital services with strong relationships.

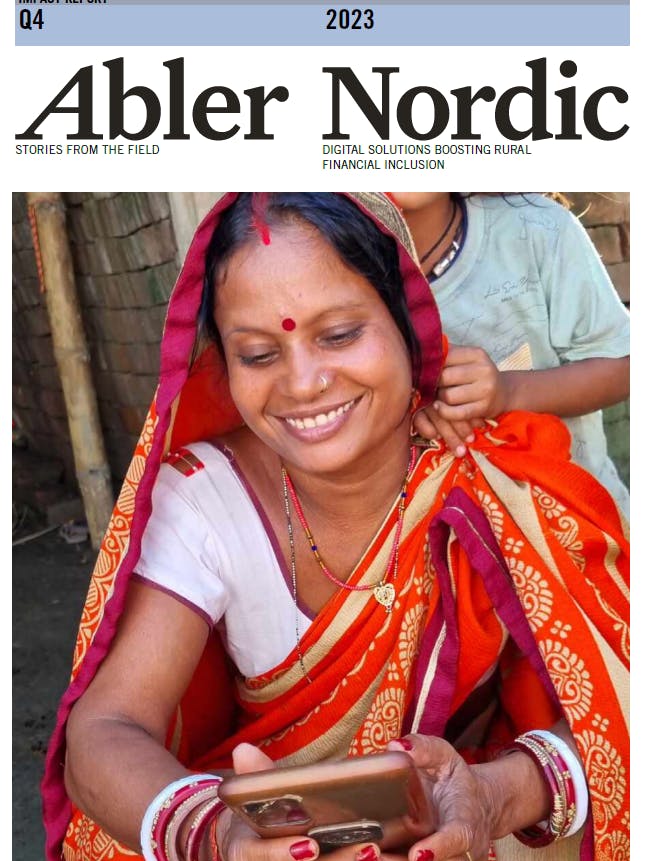

Tackling distance with Digital agents - Dvara KGFS, India

Dvara KGFS’ network of entrepreneurs in remote areas across India equipped with smartphones is breaking down barriers in accessing digital services and growing their own standing in their community. “The villagers now treat me as a mini bank,” explains Mangaiyar Selvi, Dvara KGFS digital agent in Edayapatti, Tamil Nadu.

Tech solutions for rural entrepreneurs – Juhudi Kilimo, Kenya

For smallholder farmers and rural small business owners, accessing financial services digitally through Juhudi Kilimo helps them hurdle the constraints they face with competing demands on their time and mobility. For the 70% of Juhudi’s customers who are women, social norms compound the issue of ‘time poverty’, highlighting the particular need for convenient, time-saving services

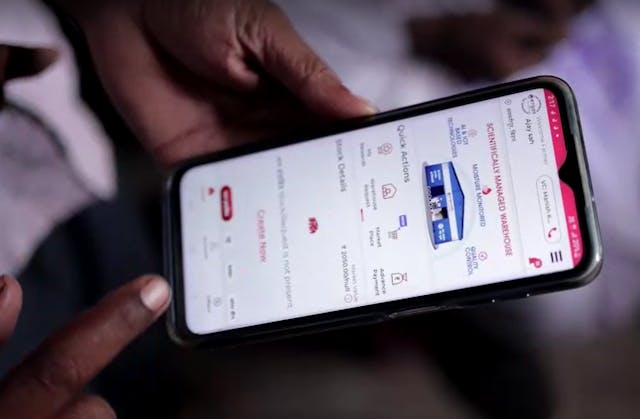

Building a digital value chain for smallholders – Ergos, India

Lack of grain storage options are one of the many challenges smallholder farmers in India face, leading many to sell immediately after the harvest when prices are lowest. We look at how Ergos is on a mission to change that through digitizing the value chain. “The farmers are no longer the price-taker, but the price-maker,” explains Kishor Jha, CEO and co-founder of Ergos

No time to waste to reach the SDGs by 2030

Coming into force in 2016, the Sustainable Development Goals (SDGs) represent a shared global commitment to address pressing challenges and create a more sustainable and equitable future. We are now over halfway to the 2030 deadline, yet the world is not on track to reach the SDGs. The financing gap in developing countries totalled USD $2.5 trillion in 2015, but now amounts to a whopping USD $4 trillion. Substantial investment in financial inclusion – which plays a pivotal role in advancing many of the SDGs – is critical.

Read about how Abler Nordic’s investments contribute.

Abler Nordic Q4 2024 Impact Report